If you have replaced your roof within the last 5 years please send PAID receipt for installation or a statement from a licensed roofer showing installation date/estimated age of roof to documents@gisnola.com

New Kenner Location: 2400 Veterans Ste 115

-

Address: 3815 MacArthur Blvd New Orleans, LA 70114

-

Phone: (504) 875-4077

-

Email: info@gisnola.com

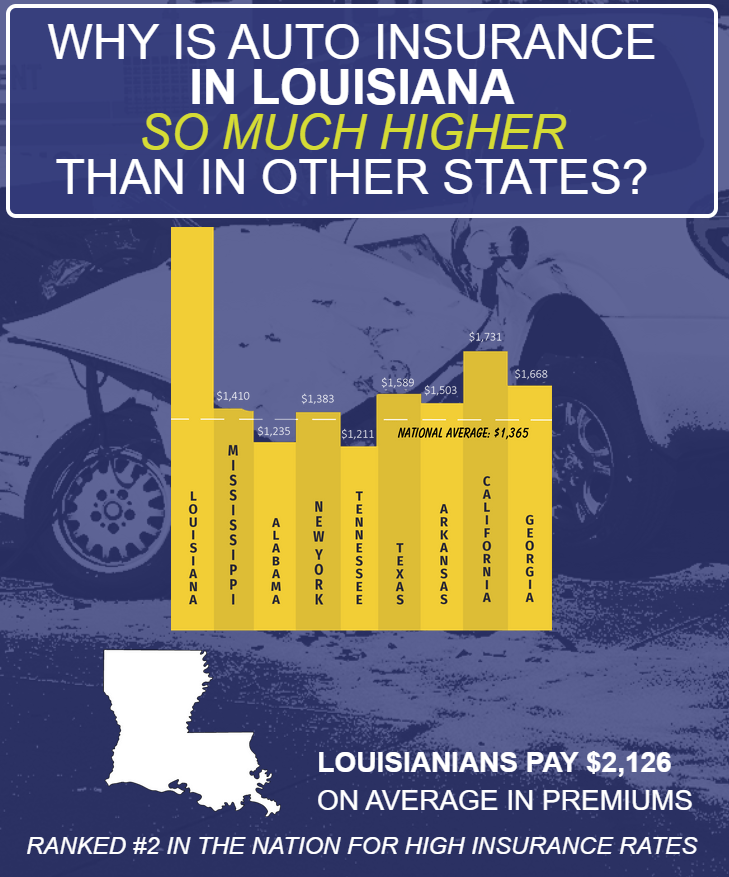

Louisianans pay $2,126 on average in auto premiums. We are ranked #2 in the nation for high insurance rates! The national average is $1365.

Here are the top most expensive states:

STATE AVG COST

Louisiana $ 2126

California $ 1731

Georgia $ 1668

Texas $ 1589

Arkansas $ 1503

Mississippi $ 1410

New York $ 1383

Alabama $ 1235

Tennessee $ 1211

If you live in New Orleans, you pay A LOT more. But why?

Why is Auto Insurance in Louisiana, and in New Orleans in particular, so much higher than in other states?

What makes us so different?

Our Laws Make Us Different.

There are four laws in particular that drive up the cost of auto injury lawsuits, and in the end WE ALL PAY.

1. Seatbelt Gag Rule

In LA, evidence of whether or not a plaintiff was wearing their seatbelt at the time of an accident is NOT ALLOWED to be submitted as evidence. Seatbelts are legally required and proven to reduce injury in accidents, thereby reducing the cost of medical bills and the cost of injury lawsuits. But in LA, it is ILLEGAL to let a judge or jury know whether seatbelts were worn.

2. Medical Bill Secrecy

Judges and juries in LA are also not allowed to know what your health insurance company actually paid for medical bills – only the initial charge before prices were negotiated. This means cases are “valued” much higher than what it actually cost to treat the victim’s injuries.

3. Jury Trial Threshold

LA has the highest in the nation at $50,000 or higher; a judge, rather than a jury, will decide your case. The end result is a trend of cases with higher value, but low enough to avoid a jury in the hopes of landing the right judge. Maryland has the next highest threshold at $15,000 and 32 states have NO THRESHOLD AT ALL.

4. Direct Action

LA is one of only three states where a plaintiff can sue you AND your insurance company! Most states recognize that bringing an insurance company into a lawsuit encourages a jury’s tendency to award larger damages. It’s human nature to see a company in a different light than a real person paying a very real bill.

What can you do about the cost of auto insurance in New Orleans?

First off, next time our state legislature is in session and are discussing insurance, hound your representatives to change these laws. We need our legislators and Governor to be on the same page and prioritize changing these laws. Let’s fix our broken legal system. Get involved at https://action.lafreeenterprise.org/

Until then here are few tips:

- Increase your comprehensive and collision deductibles to at least $500.

- Drop comprehensive and collision coverage on older cars.

- Do not file small claims. Of course if you are potentially liable for damages to someone else, it is always wise to file a claim.

- Drop windshield specific coverage. Some carriers offer a separate deductible for cracked windshields. Save your money and pay a windshield claim (if you ever have one) out of pocket.

- Slow down. Speeding tickets will drive up your premium.

Need an Auto Quote? Get started here.

*Source: 2018 car insurance rates by state, www.insure.com